Author Cori Arnold’s Quiet Journey From $260K In Debt to Becoming a Millionaire

I have always found myself drawn to people and the story of their lives. Akin to “Curious George,” my radar antenna regularly leads me to fascinating encounters with humanity. (Note: Can’t wait to launch into the book “The Power of Strangers: The Benefits of Connecting In A Suspicious World” by Joe Keohane).

In today’s online social networking world, my tribe exists on LinkedIn. And that leads me to my next Great Books, Great Minds article featuring Corianne (Cori) Arnold. She is the author of three money-related books:

You’re Approved: Get Approved For Credit and Pay The Lowest Interest Rates

Upon discovering Cori on LinkedIn, I was prompted to reach out to her largely out of curiosity because she is from my home state of Ohio.

In our conversation, I made Cori chuckle when I joked about the one thing I don’t miss about people from the Buckeye State — the fact that virtually everyone begins and ends each sentence with “Go Bucks!”

In any event, I digress. Being the forever curious person, I did a little online research on Cori and discovered this emblazoned on her website:

I'm Cori Arnold - Author, Animal Lover

I went from $260K in debt to becoming a millionaire in 10 years.

I'm not special. I don't have rich parents.

You can do this too!

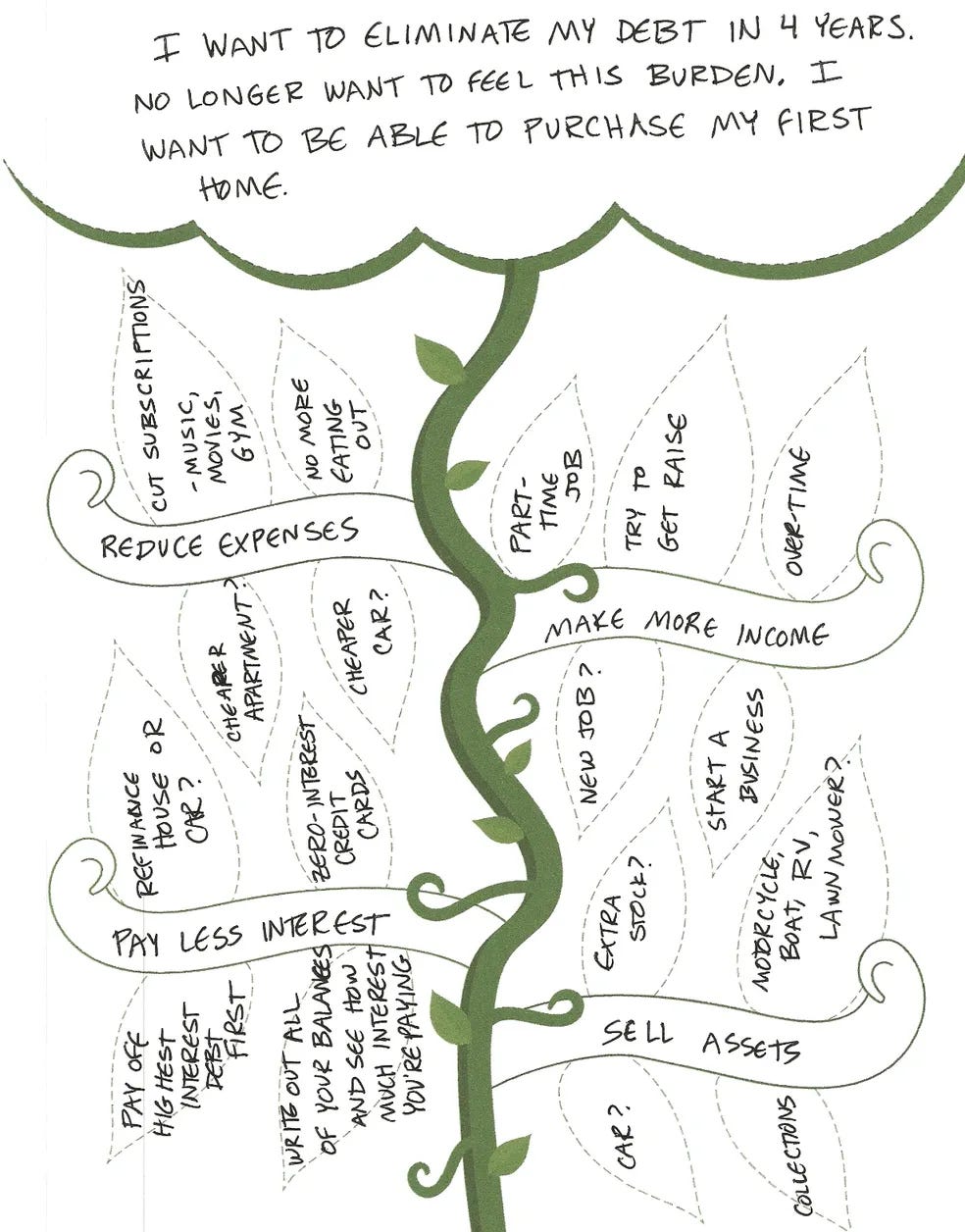

I was also intrigued by her Beanstock Goals concept. Here, check this out.

Cori also received degrees in accounting and economics before getting her MBA from the UCLA Anderson School of Management, which she could easily gloat about. But I found her to be very authentic when we talked, a refreshing alternative to authors who give off the “I am this amazing author who has a bestselling book that’s going to get me on CNN” vibe.

I interviewed Cori by phone recently while sitting in a boisterous coffeehouse in Denver’s Cherry Creek North District. Here’s what she had to share:

Michael: OK, I have to ask you right out of the gate, how does an everyday, humble person like you from Ohio achieve millionaire status. How did your journey begin?

Cori: [laughter] So it feels like it’s been pursuing this goal for a long time. But I recently accomplished it, so it’s pretty exciting. So I’m 40 now and growing up in my 20s, I was just, I mean, I was stupid with money. I was the finance major versus among all my friends. Yet I was the biggest spender and the person in debt. Sure there was a part of me that was supposed to know about personal finance. But I just didn’t have the discipline in my 20s.

Michael: What led you then to eventually pursue a different path with money?

Cori: I received my initial wake-up call while pursuing an MBA in my late 20s. Upon graduating, I had accumulated so much debt. It was about $260,000 in total!

Michael: Wow!

Cori: Yeah, it was crazy. Here I was getting my MBA and I am this fancy student at UCLA. And it was also a good time to invest in real estate. So that was part of the debt, investing in rentals back in Ohio which I really knew nothing about. I thought that investing in a cheap duplex in rural Ohio was a good idea. Well, that turned out to be not such a good idea. So that was about fifty grand of the $260,000.

Michael: Oh, my. Can you share more?

Cori: Well, yeah. What I learned is that in rural areas where people who can’t afford to purchase a house for $50,000, they’re probably not going to be the best renters. So that was my experience.

Michael: That’s Interesting.

Cori: Yes, it was tough to find renters. In the town where I’m from, the population there is less than 2000 people. So it was tough finding a good renter with good credit. So you kind of had to settle for, you know, people who probably didn’t have the best credit histories. So there were lots of evictions and I didn’t make any money. So that was a mistake.

Michael: Take us through what happened next.

Cori: I was actually at the time still living in Los Angeles but decided to move back to Ohio and get a job here. Once I stopped accumulating debt, I thought it would be smart to buy a fixer-upper house for myself. This actually ended up being a decent move in the end as I have the work done while living with my parents for six months. Then it’s finally livable.

Michael: So things were beginning to fall in place for you at this point?

Cori: Well, not exactly. So I moved into my newly renovated place after six months and decided to purchase a bunch of furniture. I basically maxed out all my credit cards. It was like I hadn’t learned anything. You know, I’m like 30 years old and just being stupid.

Michael: You were just doing it, huh? [Laughter]

Cori: Yea, you know, just living the dream, at least my version of it. At the time, I made decent money, probably around $70,000 to $75,000 a year. And I had my graduate degree. So I felt that I could do anything I wanted. So that was kind of my mindset back then, which, now, looking back, I feel like I was so stupid. The good news is, once I bought that last bit of furniture and maxed out my cards, it finally hit me that I’m never going to be able to retire if I continue doing what I’ve been doing.

Michael: Were there any other catalysts that sparked you to change?

Cori: I happened one day to be watching a Suze Orman special on the OWN Network. She was interviewing this woman who couldn’t stop spending money. Suze then brought out a rack of clothes from this woman’s closet and said it was worth, like, I think $6,000 or $7,000. She then brought out a table full of cash, around $6,500. Suzi then asks the woman, “What would you rather have, the clothes or the money?” For some reason, that just hit me.

Michael: Hit you?

Cori: Yes, like what am I doing? I’m buying all this stupid furniture that basically has little or no value after you purchase it versus saving up my cash and doing something better. That’s when the lightbulb went off for me. When I stepped back and actually compared the two, I thought, ``I want the cash.”

Michael: What was your next step?

Cori: At that point, I decided I was going to get serious about my money. So I went and opened up a spreadsheet and began listing all my debts. I listed all of my monthly payments, my interest rates, and then, basically, from that, I was able to calculate the annual interest expense. That’s when I realized that I was paying like $15,000 a year in interest.

Michael: Wow

Cori: So then, I’m like, “Oh, my gosh. I’m working so hard.” My job was kind of stressful, and, you know, I was working a lot of hours, and I was, like, “Oh, my gosh. I’m literally throwing away, like, over $1,000 a month. It’s just disappearing.” So, again, another wake-up call. So, at that point, I was so pissed. It was game-on in terms of my deciding to do whatever I had to do to get rid of this debt.

Michael: What exactly did you do?

Cori: So, in the beginning, basically, I refinanced my house to a lower rate. I then was able to consolidate one of my student loans, which was at like eight or nine percent. It was pretty high back then. So that helped to get me on the right track a bit.

Michael: What was next?

Cori: Then I decided the duplex I had purchased had to go because I was losing money every month. I was paying a decent rate of interest on that because it was considered a commercial property. So I put that on the market.

Michael: I’m curious as to how all of this impacted your credit?

Cori: Great question. What’s so funny is that throughout, I actually had perfect credit. I just liked to spend money. But I actually did pay all of my bills on time. The good news is that I started receiving a lot of zero percent credit card offers. So I went ahead and did that.

Michael: Yes, but...

Cori: You already know where I’m going with this. So here are my thoughts — For anyone thinking of pursuing zero interest cards, I advise you to make sure you’re committed going into paying them off within the 12-month or 18-month term. Otherwise, you’ll create a worse problem for yourself.

Michael: Right!

Cari: So I did all that. But I didn’t sell the duplex right away. That took about a year. Once I sold it, though, my debt went down significantly, somewhere in the neighborhood of $180,000 around two years into it. And then I began getting so serious about my expenses. I mean, I started cutting lots of small things out of my life.

Michael: Do you have any examples of some of the small items that you cut?

Cori: Sure. I had a roommate just temporarily for a couple of months. And she left her Keurig machine with me when she departed. SoI started using it. Problem is, I was spending somewhere in the neighborhood of $10 every week on Keurig cups. I thought, “That is not something I need to live.”

Michael: Very interesting

Cori: Yeah, that was just one example. But, there were a lot of areas where I really trimmed back. And once I got on that goal, I really just made it a mission. Sure it took me like five years to get rid of all of the debt in the end. And, luckily, I kept getting raises at work, which helped. But I was careful to not increase my lifestyle at all when I got those raises.

Michael: Can you share more about that last point?

Cori: Basically by not blowing that money on random lifestyle wants, I was able to direct that money toward paying down more of my debts. In the end, it was really about seeing the numbers on paper and thinking, “What am I doing to my life?” It was about having the intensity of focus in terms of tracking that goal. I believe that tracking is such an important factor in achieving your goals.

Michael: Tracking?

Cori: Yes. Back in 2009 when I was still in Los Angeles, I was thinking, “Yeah. I am financially savvy.” While I had listed my debts, I had never actually added the interest rates and did the calculations. So getting to where I am now was largely about checking the details, regularly assessing the progress I was making in terms of my goals. This is not a new concept — it is contained in all of the popular financial books.

Michael: So tell us about the books you authored.

Cori: It’s so funny that I’ve always had a desire to write. But because of my bad spending habits, I always really needed to have a full-time job, to pour all of my energy into that. But I hope to do a lot more writing in the future.

Michael: That’s cool.

Cori: Yeah, we’ll see. I mean, when I say soon, it’s probably the next few years. But we’ll see.

Michael: And describe for us the importance that books have had in your life?

Cori: It’s kind of a funny thing how people who really need to read are the last to pick up a book. Me, I love learning and taking in different experiences.

Michael So what sort of response have you received from those who have read your book?

Cori: The book on flipping houses, people really seem to like it. Everything I write about in my books is pretty simple. I love to simplify what others might otherwise consider complex.

Michael: What is the main theme you are trying to get across in Making Real Estate Your Part-Time Hustle

Cori: I really stress in the book the importance of paying cash if you can. I know that that might not always be possible. Heck, I couldn’t even do that with my first property purchase.

Michael: So what authors and books, sorts of books have influenced your thinking over time? I recall you mentioning Suze Orman, for instance.

Cori: I’m actually a huge fan of Suze Orman and Dave Ramsey. I don’t think the two of them are too fond of each other, though. They have totally different styles.

Michael: In what way?

Cori: So Suze is a little more okay with debt. Dave hates debt.

Michael: So talk to me first about Dave Ramsey.

Cori: Sure. I began following his advice over 10 years ago. And it’s really paid off for me as I don’t know that I’ve accumulated a cent of debt over the course of 10 years

Michael: Oh, that’s awesome. Can you elaborate a bit more about Dave Ramsey’s perspectives and how it has influenced your own philosophies around money?

Cori: Sure. So this is actually kind of funny. In my early 20s, my cousin, who’s older than me, decided that he was going to be a Financial Peace University Coordinator. So I actually took a class with my mom back then.

Michael: What did you gather from that experience?

Cori: Honestly, I didn’t quite comprehend those lessons at the time. But, I’ve known about Dave Ramsey for quite a while. And once I kind of got on this track where I was more focused on the debt, I really started listening to his podcast. That’s how I discovered how listening to a podcast or something that inspires you every day, can help so much.

I agree with most of what Dave says, particularly his point about staying out of debt. But to get out of debt, I definitely did not follow the baby steps he recommended even though I think they are good for some people. I mean, I definitely agree that momentum helps. Dave has a principle he calls the “Snowball Method,” where he advocates paying off the smallest debts first up to the biggest?

Michael: Yes, I’ve actually used that method over the years to great success.

Cori: I mean, I think that definitely works for most people, especially people who need that momentum boost at the beginning. For me, I just felt like I was paying so much interest on my debts. For example, the student loans at the time that I graduated were at like eight and nine percent. So I felt like I had to get rid of those first. So I didn’t quite follow his method as I prioritized the debts I wanted to pay off by interest rate. But I still agree in general with his snowball philosophy for gaining momentum when you are getting started with this.

Michael: Can you share more on this point?

Cori: The thing is, if you don’t have any momentum or inspiration, you’re going to quit. So I definitely agree with his debt-free approach. Ten years ago, I would have never thought, “Oh, I can pay for a property in cash.” But the more I listen to him, the more cash I save, and the more I see that “Wow. This really is reality.”

Michael: And you’ve obviously read his books along with the podcast?

Cori: His first book, oh, what is it called? Oh, yes, The Complete Money Makeover

Michael: I’ve definitely read it

Cori: Yes, in his “The Money Makeover,” book where he talks about, among other things, compounding interest. He talks about the baby steps to getting out of debt. That was huge for me. I think he said something to the effect of “you don’t want to be on the opposite side of this,” which is so true. At the time, you know, my interest was just climbing and climbing as my principal balances weren’t going down very fast.

Michael: So what’s it like being on the proverbial other side?

Cori: Being on the other side, I’m like, “Oh, my gosh, compounding is so amazing.” I have some investments in mutual funds and a retirement account. I mean, it’s crazy how simple this advice is, and yet how sometimes it’s hard for us to believe it’s really going to happen. But, literally, when you are consistent over the years, it’s crazy how your money grows. I would have never imagined what I have in retirement right now. It’s just crazy.

Michael: So I’ve got one final question for you. What’s your greatest hope in terms of what people walk away with from reading one of your books and the lessons you impart?

Cori: I mean, there are a few things. First, I want to inspire people. I want to open their minds and let them know that there’s not just one path for everyone. For me, I grew up with an awesome family, but they're so stuck in their traditions. But I feel like everyone has their own path. And I want people to feel comfortable taking their own path and feel okay with actually getting out of their comfort zone and taking a risk. In all three books, I try to push that.

While money isn’t the main topic in any of the three, I definitely want people to grow in the awareness of their finances and how it impacts their life. Because, you know, I think we all have that deep desire to have more time for ourselves and not be locked into a job literally until we’re 65 or 70. So I hope to give inspiration and maybe a little education about a topic that I’ve had the good fortune to experience. Hopefully, they’ll be able to take something from it or learn from it. Maybe it’s just one thing. But just that would be awesome, you know, and make me very happy.

You can connect with Cori on Twitter @mindsetcori — Please let her know that “Great Books, Great Minds” sent you.