Unsplash Photo Credit: Alexander Mils

You wake up early, the sun barely peeking over the horizon, signaling the start of another day. The alarm's blare echoes in the room, a harsh reminder of the financial treadmill you're on.

As you sip your coffee, the weight of financial stress settles over you like an unshakeable fog. You're not alone.

Across America, millions are grappling with similar struggles, caught in a relentless cycle of economic pressure and uncertainty.

The numbers paint a stark picture: inflation is the top financial concern for many, with 35% of Americans identifying it as their most pressing financial issue.

You might be among the 88% who feel some level of financial strain, constantly calculating and recalculating, trying to stretch every dollar just a bit further.

The dream of financial security feels increasingly out of reach, with surveys suggesting that the average American believes they need to earn over $186,000 annually to feel financially stable. This figure is more than double what most full-time workers earn, creating a chasm between reality and aspiration that seems insurmountable.

The pursuit of financial stability often drives you to take on multiple jobs or freelance gigs. The gig economy, once seen as a path to freedom and flexibility, now feels like a necessity. Yet, despite the hustle, the financial burden doesn't ease.

Instead, it compounds, leading to burnout and a profound sense of dissatisfaction. The mental toll is significant, with 41% of Americans acknowledging that their finances negatively impact their mental well-being. Each day feels like a race against time, a battle to stay afloat, and it's wearing you down.

Unsplash Photo Credit: Dan Gold

You see this struggle reflected starkly in younger generations and middle-income earners. Millennials, in particular, report higher levels of financial stress, a stark contrast to the expectations of their parents' generation.

Middle-income Americans, once the backbone of economic stability, now find their confidence at record lows. This pervasive financial fatigue breeds a dangerous cycle, where money problems are ignored until they explode into crises, further exacerbating the stress and instability.

In this climate, turning to literature for insights and strategies becomes a lifeline. Here are five notable books that delve into the intricacies of today’s job economy and offer paths to financial sustainability.

Enrico Moretti's "The New Geography of Jobs" explores the shifting employment landscape, highlighting how innovation and technology are creating "brain hubs" in cities like San Francisco and Boston. Moretti’s analysis reveals the growing disparities between communities and offers a sobering look at the economic divide.

Jamie Woodcock and Mark Graham's "The Gig Economy: A Critical Introduction" provides a deep dive into the rise of freelance and contract work. The book critically examines the benefits and challenges of gig work, shedding light on its impact on traditional employment and its broader social implications. As you juggle multiple gigs, this book offers context and understanding of the larger forces at play.

For those new to managing their finances, Chelsea Fagan's "The Financial Diet: A Total Beginner's Guide to Getting Good with Money" serves as a practical guide. Fagan’s book covers the basics of budgeting, saving, investing, and developing healthy financial habits, providing a foundation for financial literacy and empowerment.

Vicki Robin and Joe Dominguez's "Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence" takes a holistic approach to personal finance. The book emphasizes aligning spending with personal values and offers strategies for achieving financial independence. It's a reminder that financial well-being is not just about numbers but about living a life that reflects your values and priorities.

Morgan Housel's "The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness" delves into the emotional and psychological factors influencing financial decisions. Housel’s insights help you understand how attitudes and behaviors around money affect financial well-being and overall happiness, offering a perspective that transcends mere financial management.

As you navigate the complexities of your financial life, these books provide guidance and insight, helping you understand the broader economic trends and personal strategies for financial well-being.

Yet, the journey remains deeply personal, fraught with challenges and uncertainties. The relentless pursuit of financial stability requires resilience, adaptability, and a willingness to confront the harsh realities of the modern economy.

The path to financial security may be arduous, but each step forward, no matter how small, is a testament to your determination and resilience. In this shared struggle, you find solidarity and a reminder that while the journey is tough, you are not alone.

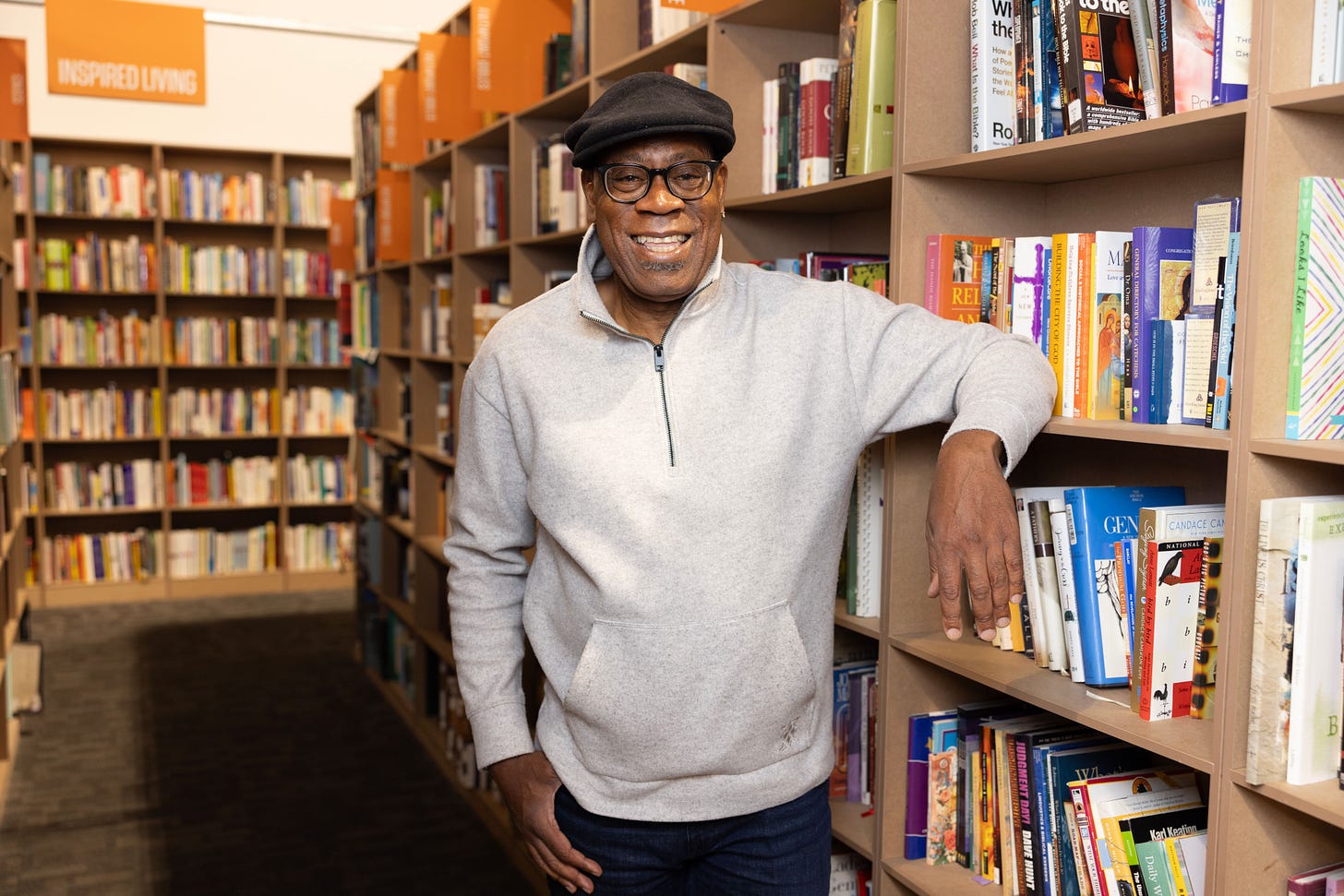

Since January of 2020, Great Books, Great Minds has provided subscribers community, connection and conversation around books for free—no paywall. But our future relies on you. At $6.00/month or $60.00 per year, please help us sustain our vision of impacting one million readers worldwide by 2030.

Diamond Michael Scott, Global Book Ambassador and Influencer

Thank you it looks like we need to find a revenue stream that replaces a working income. We need a job that pays a good salary that we can sock away some then we need investments